~Pune currently ranks 4th nationwide in its contribution to India’s total AUM, accounting for 4.12% of the country’s ₹68 lakh crore asset base~

As India advances toward a projected 1$5 trillion GDP by 2027, significant investment opportunities are emerging across large, mid, and small-cap segments.

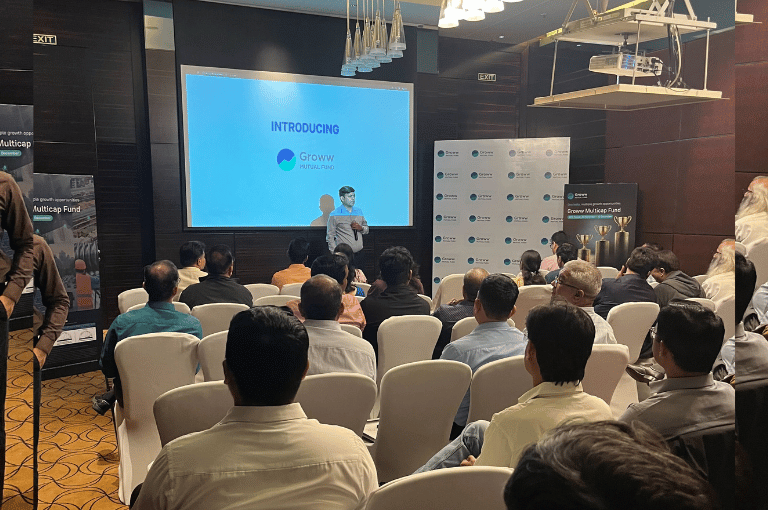

In response to this potential, Groww Mutual Fund recently hosted an event in Pune, where the Groww Mutual Fund team introduced the Groww Multicap Fund—a fund designed to offer investors exposure across India’s market segments.

The event provided mutual fund distributors with insights on how a multi-cap approach seeks to capture India’s evolving economic landscape, empowering them to better guide their clients. During the session, Anupam Tiwari, Head of Equity at Groww Mutual Fund, highlighted key growth opportunities driving India’s economic progress.

Export expansion, driven by initiatives like the Production Linked Incentive (PLI) scheme and Make in India, is positioning India as a competitive player on the global stage. Infrastructure development is another major driver, with the ₹111 lakh crore 2National Infrastructure Pipeline (NIP) set to enhance connectivity and productivity across the country by 2025. Additionally, a rising demand for 3premium goods in sectors such as real estate, automotive, and jewellery reflects India’s shift toward high-value consumption.

Digitization is accelerating growth across technology, manufacturing, and consumer services, creating new pathways for economic progress. Furthermore, expanded access to capital and supportive policies are enabling small and mid-cap companies to thrive, particularly in sectors like infrastructure, financial services, and IT. Finally, rapid urbanization is fueling demand in consumer goods, housing, and services to meet the needs of an expanding urban population.

Together, these growth drivers provide multi-sector opportunities across large, mid, and small-cap companies, forming a strong foundation for India’s economic expansion and wealth creation.

To leverage India’s diverse growth potential, a multi-cap approach provides exposure across large, mid, and small-cap companies, capturing broad-based growth. The Groww Multicap Fund will help investors access opportunities across sectors, investing in high-quality stocks at reasonable valuations to support long-term wealth creation.

Manish Ranjan, Head of Sales and Distribution at Groww Mutual Fund, emphasized the crucial role mutual fund distributors play in helping investors understand how products like the Groww Multicap Fund may provide access to India’s growth potential. 4Pune currently ranks 4th nationwide in its contribution to India’s total AUM, accounting for 4.12% of the country’s 5₹68 lakh crore asset base. This underscores the important role distributors have in guiding investors through these emerging opportunities.

Groww Mutual Fund aims to support distributors with research-based insights and products that may help investors tap into India’s economic growth potential, empowering them to better serve their clients.

The NFO for the Groww Multicap Fund is set to open on November 26, 2024, and will be available until December 10, 2024. Mutual fund distributors interested in offering this opportunity to their clients can reach out to the Groww Mutual Fund team at partners@growwmf.in for further details.